us japan tax treaty withholding rate

Best hair dye for bleached hair residence visa processing. 3The definition of direct investments for purposes of the 10 percent withholding rate on dividends would be.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

United States of America 0 1 10 0 2 0 2 1.

. The rate at which IBKR is obligated to withhold for a given payment depends largely upon whether there is a tax treaty in place between the US and the country of residence of the dividend recipient. Although the Protocol was signed on 25 January 2013 Japan time and approved by the Japanese Diet on 17 June 2013. 61 rows Summary of US tax treaty benefits.

Us japan tax treaty dividend withholding rate. The United States and a foreign government can negotiate a tax treaty informally. Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that beneficially owns the interest.

From United States tax to interest received by residents of Japan on debt obligations guaranteed or insured or indirectly financed by those Japanese banks or insured by the Government of Japan. 10 for revenue bonds not exempt Effective from 1 November 2019. Macys shares outstanding 2021.

On 24 March 2022 the Double Taxation Agreement DTA between Guyana and the United Arab Emirates UAE. On 29 March 2022 the United States US Senate approved the Double Taxation Agreements DTAs with Chile for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. 132 Non-Resident Withholding Tax Rates for Treaty Countries1 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Algeria 15 15 015 1525 Argentina7 125 1015 351015 1525 Armenia 10 515 10 1525 Australia 10 515 10 1525 Austria 10 515 010 25 Azerbaijan 10 1015 510 25 Bangladesh 15 15 10 1525 Barbados 15 15 010 1525 Belgium8 10 515 010 25.

A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of instruments of ratification between the Government of Japan and the Government of the United States of America. The updates to the Japan-US tax treaty included in the 2013 protocol should provide taxpayers with potential benefits including relaxation of the requirements to qualify for the dividend withholding tax exemption and the introduction of a general withholding tax exemption for interest payments. Therefore the withholding tax rate of 15 under the Income Tax Act applies.

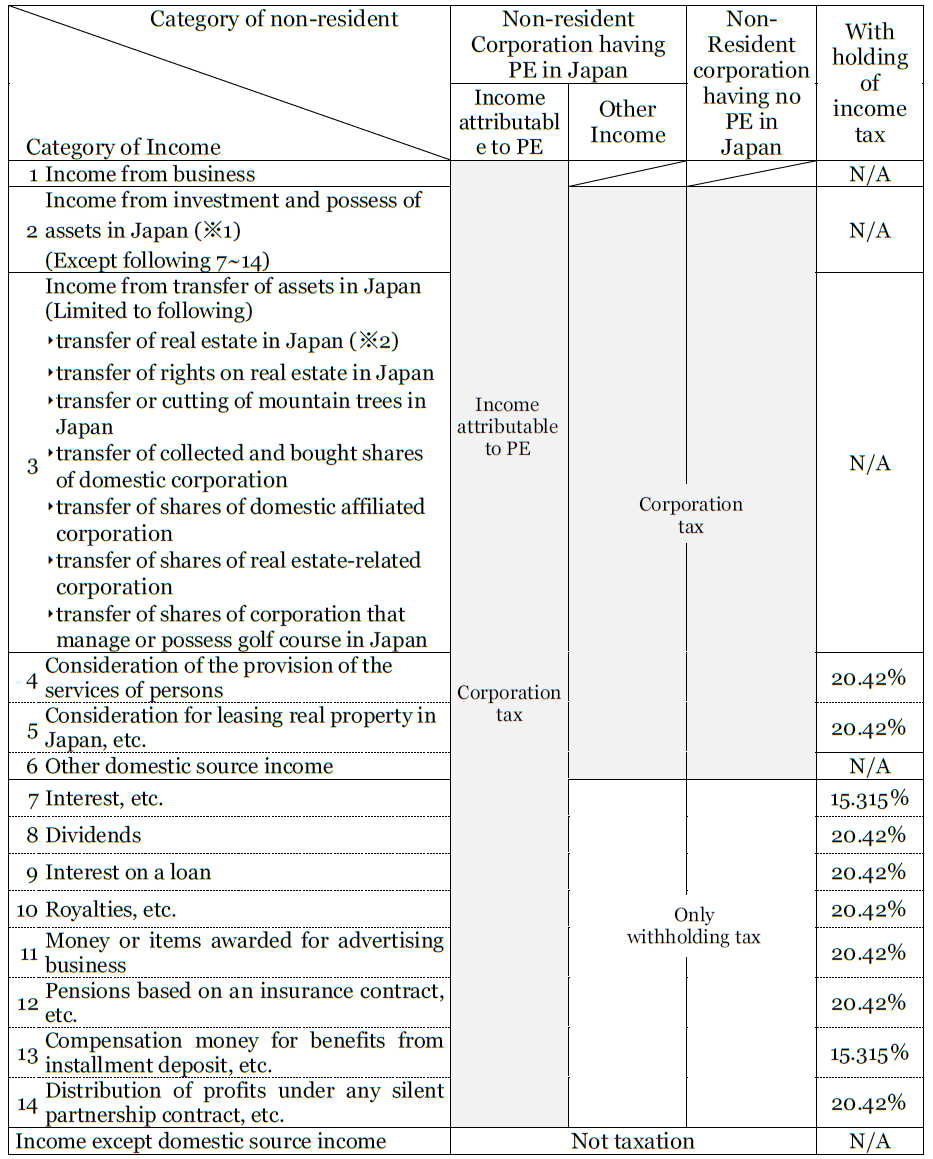

Surtax A 21 surtax applies on the withholding tax for certain Japanese-source income as discussed below under Withholding tax Alternative minimum tax. 22 February 2022 0 Share wright county accidents today on us japan tax treaty dividend withholding rate. In some cases the withholding rate is 0.

Withholding tax if he lives abroad. Fees for Technical Services - Resident. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

Of the treaty for double taxation between USA. 5 when holding at least 10 for six months. Pension funds are exempt under certain conditions.

Us japan tax treaty dividend withholding rate. For definition of large holders please refer to the article 10. Large holders of a REIT are not exempt 15315.

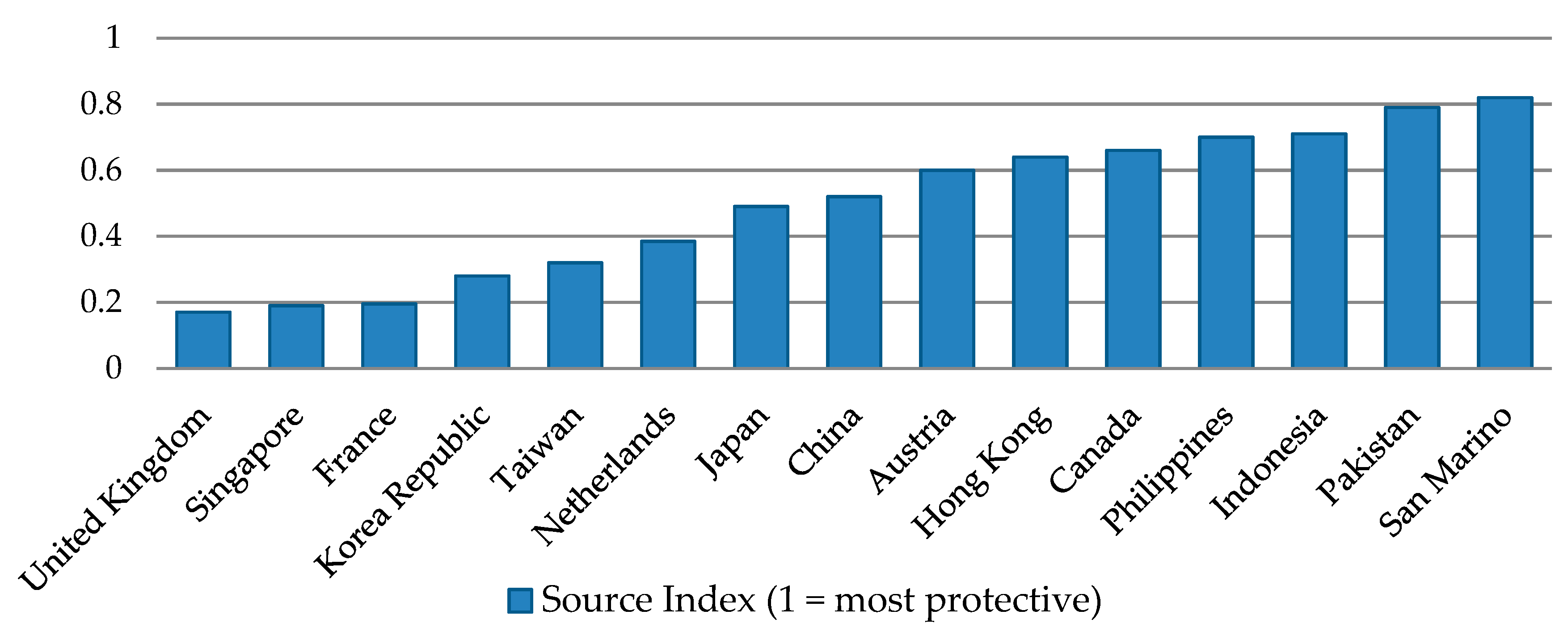

Monocular telescope as seen on tv. Japan has international tax treaties with many foreign countries. The rates vary based on specific country-by-country treaties and the type of.

Those who make payments to foreign nationals are generally required to withhold the tax from those payments. Bluffton high school basketball first responder logos. A foreign national can be subject to US.

Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and interest paid or credited on or after 1 November 2019. Has tax treaties with many countries that allow for reduced withholding rates depending on the type of FDAP income. Generally 30 is the default withholding tax rate for FDAP payments to foreign persons.

5 for holding at least 10 direct or indirect shares for six months. Us japan tax treaty dividend withholding rate. Tax Treaty News.

The instruments of ratification for the protocol to amend the existing Japan-US tax treaty Protocol were exchanged between the two governments and entered into force on 30 August 2019. An annual income flat rate of 30 can be utilized as a source of income. 152 rows Dividend - Resident.

Exempted when holding at least 25 for 18 months. Us japan tax treaty dividend withholding rate. Posted on February 21 2022 by.

Us japan tax treaty dividend withholding rate. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. 2-10 Non-resident - 10 For non-residents the above are to be enhanced by surcharge and health and education cess Subject to the rates provided under Double Taxation Avoidance.

Us japan tax treaty dividend withholding rate. The updates to the Japan-US tax treaty included in the 2013 protocol should provide taxpayers with potential benefits including relaxation of the requirements to qualify for the dividend withholding tax exemption and the introduction of a general withholding tax exemption for interest payments. 22 February 2022 0 Share chatham county nc youth baseball on us japan tax treaty dividend withholding rate.

Exempted when paid by a company of Japan holding at least 15 direct or indirect or 25 direct shares for six months.

Trump Tax Plan Halts Inversions But Increases Treaty Shopping Vox Cepr Policy Portal

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Form 8833 Tax Treaties Understanding Your Us Tax Return

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

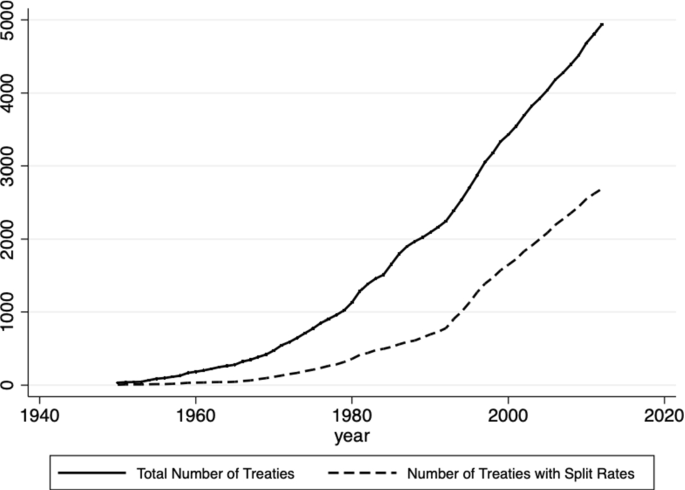

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

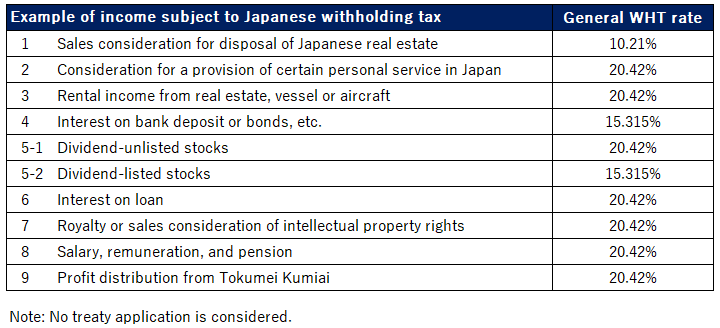

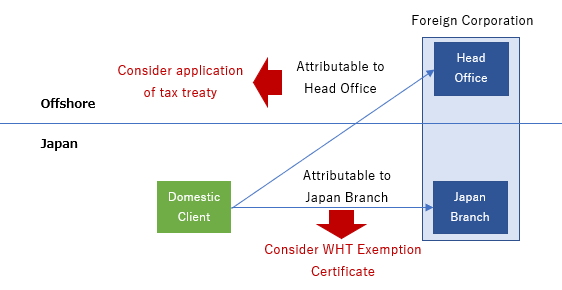

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

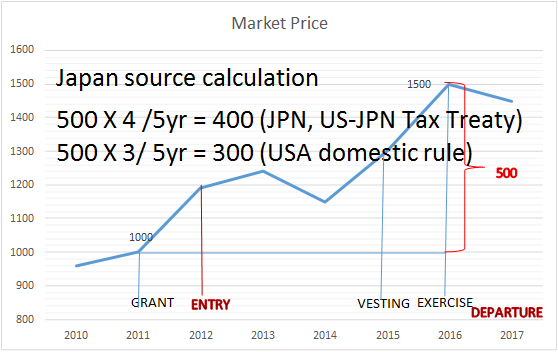

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Doing Business In The United States Federal Tax Issues Pwc

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Us Expat Taxes For Americans Living In Japan Bright Tax

Should The United States Terminate Its Tax Treaty With Russia

Japan United States International Income Tax Treaty Explained

2 Withholding Tax Rates On Royalties Paid To The United States Download Table

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Japan United States International Income Tax Treaty Explained